Not for profits tend to be the least complained about private health insurers, overall complaints are rising year on year and there is the odd complaint that has the feel of the current Coles and Woolworths debacle.

Our worst private health insurer by number of complaints per quarter by a very big margin is Defence Health, a new report reveals.

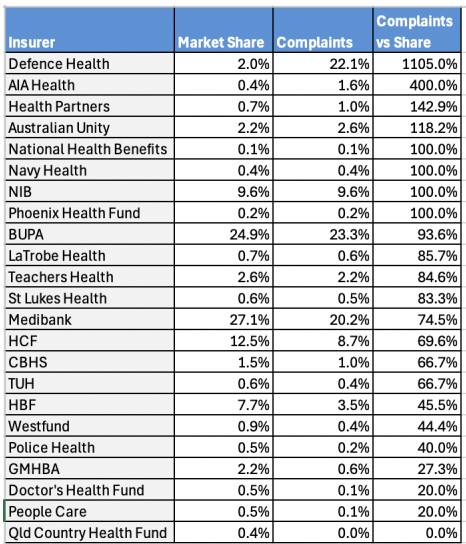

Despite having just a 2% share of the private health insurance market, Defence Health managed to generate a whopping 23% of all complaints from January to June this year.

This is according to the latest update of the Office of the Commonwealth Ombudsman released this week.

Defence Health has been somewhat of a star performer in the complaints stakes for quite a while, apparently as a result of a decision to upgrade its systems in early 2023 and then progressively failing at the upgrade.

Complaints about the service increased from less than 40 in the April to June Quarter 2023, to over 300 in October to December 2023. Nearly 18 months from when they started fixing things the complaints are still rolling in at the rate of about 200 per quarter.

If you exclude Defence as an outlier, the general pattern for the rest of the crowd tends to be that the percentage of complaints follow market share percentage, with a few notable exceptions.

If you had to pick a winner in terms of least complaints relative to size of market share not for profits HCF and HBF, both come near top of class with complaints running at only half and two thirds of their market share respectively.

Of our big for-profit market share leaders, BUPA and Medibank, BUPA performed worst with 23.3% of total complaints against its market share of 24.9% and Medibank better with only 20.2% share of complaints against a market share of 27.1% for the quarter April to June this year.

We’ve ranked all the health insurers by share and relative share of complaints from worst to best below for you to make your own comparisons.

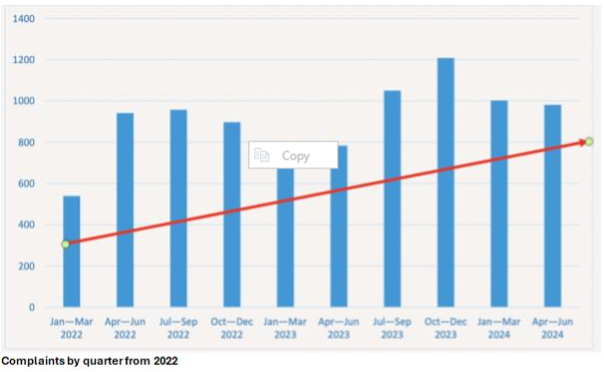

One key trend that might be emerging in the Commonwealth Ombudsman’s data is a big year on year increase overall in complaints across the board about PHIs.

In the first two quarters of 2024 the number of complaints is up by about 25% overall on the same two quarters of 2023, and although compared to the last two quarters of 2023 complaints are actually down, if you look at the trend in the graph below from 2022, complaints are definitely trending upwards.

Of the things most complained about customer service, membership terms and conditions and benefits top the list, with a significant increase in complaints about membership terms and conditions and benefits. In terms of benefits most complained about, delay in payment and the amount on the bill were the standouts, with both categories increasing over the last year by a combined average of about 32%.

In the possible category of Coles and Woolworths-type complaints, the Ombudsman looked into 23 complaints over the year where the policy holder had been admitted to hospital for treatment and their hospital policy covers them for some but not all of the item numbers for the admission and the insurer rejected the whole claim based on the few items that were excluded.

That sounds like some PHI management has been taking hints tips from Coles and Woollies.

All these complaints were resolved, according to the Ombudsman, although there is no detail on how, and a there is note from the Office suggesting there needs to be much greater clarity on the rules for policy holders in this situation from all the PHIs.