The expected increased demand for private healthcare post-covid hasn’t eventuated. Why not? And how can providers respond?

Australia’s private health care sector expected a wave of increased demand following the covid pandemic that would see admissions growth reach the levels of the 2010s.

This expectation was reasonable given the ageing and growing population, increasing prevalence of chronic illness, delayed care during the pandemic and the increasing uptake of private health insurance.

So why is the sector still waiting for growth? This article explores why demand has been so subdued and how providers can respond.

Low growth in private hospital admissions

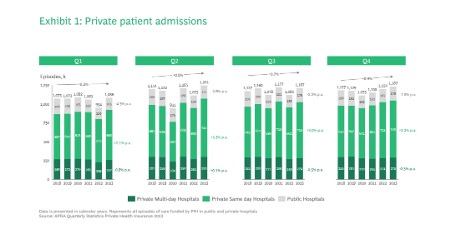

Hospitals are seeing much lower private admissions growth than expected.

From 2018 to 2023 total private admissions have grown at a compound rate of less than 1%.

While there has been some growth (2% p.a.) in same-day admissions to private hospitals, multi-day admissions to private hospitals have declined over the last five years despite the public sector also treating fewer private patients (see exhibit 1).

The financial pressure of low admissions growth has been compounded by limited growth in private health insurance rebates (increasing by 2% each year since 2019) and rising operating costs, primarily driven by higher nursing salaries and increased reliance on agency staff.

In addition, the aftermath of covid saw many experienced staff, particularly theatre nurses and unit managers, depart which disrupted teams and affected productivity.

These elements have combined to contribute to a challenging environment for private hospitals, with many struggling to break-even and several closing down.

What is driving the low growth in private admissions?

The slow growth in private patient admissions appears to have been partly driven by stagnating GP consultations and declining specialist consultations.

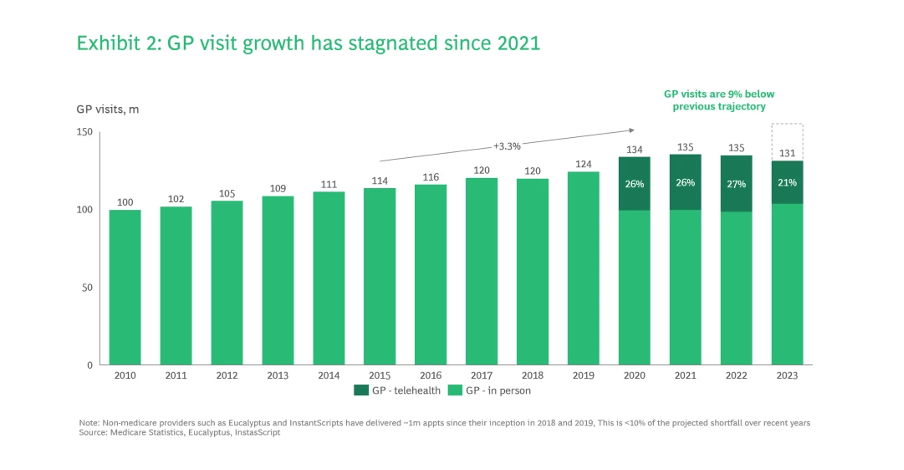

Since the onset of covid, the total number of GP consultations occurring in Australia has stalled at around 135 million per year.

This means total GP consultations are now 9% lower than they would have been had the pre-covid growth trajectory been maintained (see exhibit 2).

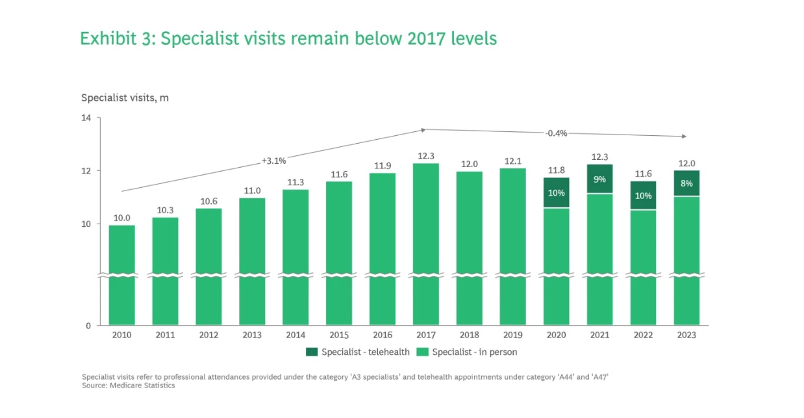

Medicare-funded specialist consultations have declined even more significantly, having peaked pre-covid in 2017, despite improved access via telehealth (see Exhibit 3).

Flat GP consultations and declining private specialist consultations means fewer patients being diagnosed and referred through for surgery or other care in private hospitals.

Workforce shortages are clearly part of the reason for both the slow growth in GP and specialist consultations and in in private hospital admissions.

The shortage of registered nurses is well known and has impacted the ability of many private hospitals to run at capacity, resulting in care delays.

Post-pandemic, many healthcare workers have prioritised work-life balance, with AHPRA registration data demonstrating that specialists in obstetrics, surgery, and ophthalmology have all reduced their average hours in private hospitals since the pandemic.

Similarly, GPs are increasingly opting for part-time roles (8% rise reaching 63% since 2022), reflecting both the increasing number of women in the workforce and shifting care-giving roles for many men.

Meanwhile, significant government investments in public hospitals have increased the demand for clinicians.

In 2022, high rates of community transmission of covid saw many private hospitals struggle with high rates of sick leave.

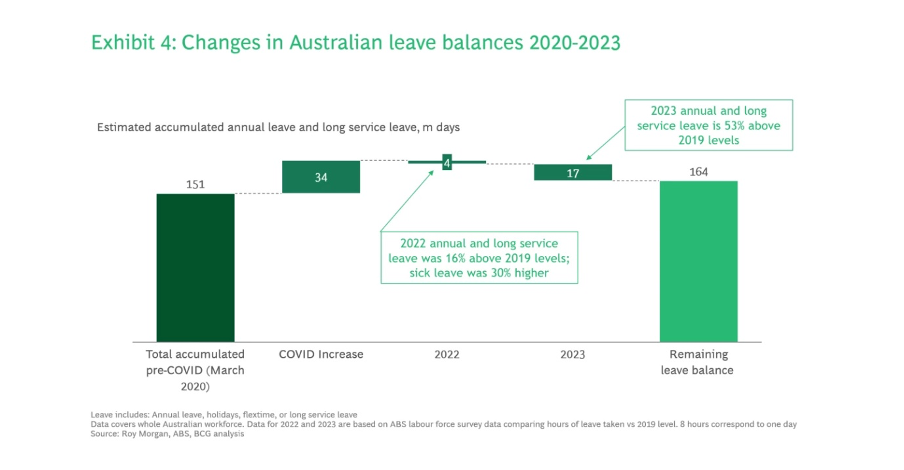

In 2023, many Australian workers, including healthcare professionals, started taking the overdue leave that they had accumulated during the peak of the pandemic, putting the workforce under further strain.

ABS Labour Force data shows that on average, Australian workers took 53% more annual and long service leave in 2023 than they did in 2019 (see Exhibit 4).

With 40% of the leave balance increase still untapped and Australians, particularly more affluent demographics, showing renewed interest in travel in 2024, 1 this trend is expected to continue impacting clinician availability.

Finally, higher out-of-pocket costs for privately provided healthcare and the cost-of-living crisis have impacted consumer demand, affecting GP and specialist consultations and private admissions directly.

Consumer confidence hit record lows in late 2022 and early 2023 as rising interest rates and higher rents put significant financial pressure on Australian households.

At the same time, out-of-pocket medical expenses continued to rise and bulk billing declined, encouraging patients to be more cautious and deliberate with their healthcare spending.

These factors, coupled with the public system’s effort to address surgery backlogs, have resulted in more patients choosing the public system over the private system.

How can private health providers succeed in this low-growth environment?

Historically, good sites and strong general management were the critical factors that drove strong revenue growth for private hospitals.

Success was built on being able to attract the surgeons and physicians whose patients kept the hospital occupied.

Competition centred on developing new greenfield opportunities and optimising brownfield expansion to capture the ongoing growth.

Strong general managers competed by operating attractive, well-run facilities with motivated and reliable staff, ensuring doctor retention and productivity.

In the new, lower-growth environment, with care increasingly delivered outside the hospital, the basis for competition in private hospitals will need to evolve.

To succeed in this new environment, providers will have to learn to compete on three new dimensions:

Differentiate your clinician value proposition to support their personal and professional career goals.

Competition for clinicians historically focused on winning high-volume surgeons and physicians by providing access to high-quality facilities and attractive amenities (e.g., parking) so they could be maximally productive.

The new environment will reward private hospitals that develop engagement models that support clinicians to build their practices while also helping them meet work-life balance goals, for example, by providing practice management support.

Hospitals should consider innovative approaches such as encouraging the formation teams of sub-specialists who work together as professional practices, aligning their goals for income, professional development, and work-life balance with the hospital’s economic objectives, such as efficient use of resources.

Strengthen your brand with patients to win in an increasingly consumer-driven market.

While many private hospitals have strong reputations in their local communities, hospitals have not leveraged these reputations directly to drive referral.

Increasingly, hospital providers need to design healthcare experiences for modern consumers, with easy booking, quick service access, prompt responses, transparent pricing, and accessible finance options such as “no gap” or “known gap” services.

Hospitals should consider mutually beneficial brand alliances with local general practices that serve their target market and direct digital patient engagement models including second opinion services.

Extend ability to capture value along the whole patient journey.

As healthcare is increasingly delivered outside hospital walls, private hospitals operators need to consider ownership stakes and investments in physical and digital infrastructure that supports a seamless experience along the patient journey and better patient outcomes.

Many hospital groups are beginning to invest in allied health services, home care delivery and digital infrastructure to create more connected journeys.

Over time, integration with diagnostics and other specialist services will need to be considered as payers push towards bundled payments and inter-disciplinary care models.

Implementing these strategies individually is tricky, and it is even more challenging to weave them into an integrated strategy that enhances market share and revenue, streamlines operations, fosters collaboration, and supports long-term growth in an evolving healthcare landscape.

BCG’s global experience has been built as many nations navigate these changes in healthcare delivery. We would welcome the opportunity to discuss how we can help you navigate this complex landscape.

Ben Kenneally is managing director and partner at BCG.

Stephen Hosie is managing director and partner at BCG.

Max McArthur is a senior knowledge analyst at BCG.

This article was first published by BCG. Read the original here.