In a confusing practice note on payroll tax relief, Revenue NSW is encouraging doctors to drop treating veterans, workers compensation patients and tourists.

Example 9, Commissioner’s Practice Note CPN 036 – Relief to Medical Centres, reads a little like a future bureaucracy featured as a central plotline in a dystopian science fiction novel.

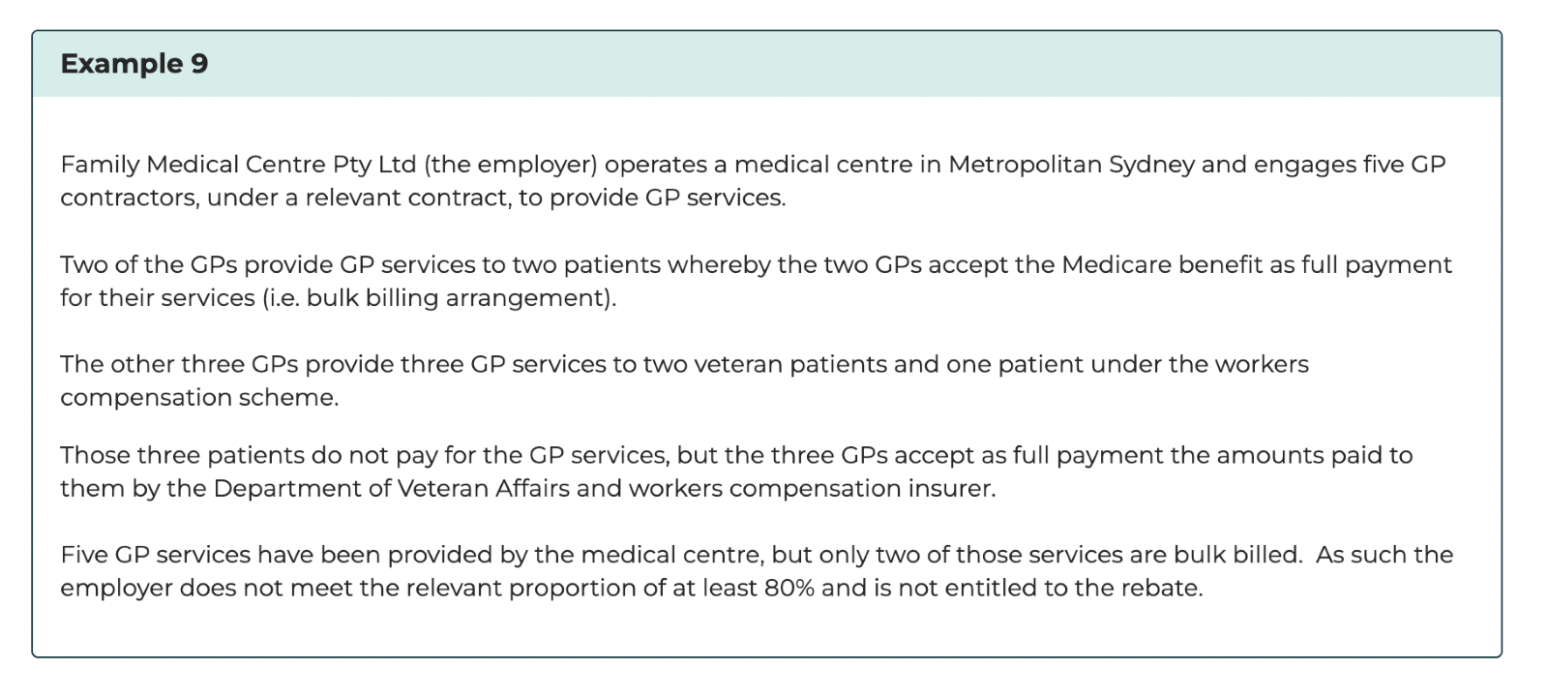

The Example (below) outlines that if you are a GP or practice wanting to take advantage of NSW’s newly minted rebate relief on payroll tax, you are going to need to give careful consideration to not treating veterans, workers compensation patients and tourists from now on, or, at the very least, not treating them as much, depending on your overall practice profile of bulk billing versus not bulk billing.

In this example, if GPs provide too many services to either veterans or workers compensation patients, then Revenue NSW is warning that the practice may endanger their ability to receive payroll tax relief.

A detailed reading of the ruling reveals that Revenue NSW is ruling every payment out which is not strictly a Medicare payment.

This is despite the fact that a Department of Veterans Affairs payment is treated exactly the same under the Health Insurance Act as a Medicare payment.

- This article was first published by The Medical Republic. Read the original here.

They are both payments directly from the federal government to cover a patient’s medical costs, one is just from another department based on their service status.

The note is likely to anger the many veterans lobby groups around the country. HSD has sought comment from a few but they could not get back to us prior to going to press.

The strict adherence to Medicare-only payments is also a trap for other types of payments which will likely become controversial with key lobby groups around the country.

For example, any payment from a tourist paying privately because they do not have access to Medicare, would be trapped within the Revenue NSW model so GPs would be discouraged from conducting such consults.

“Australian state discourages their GPs from treating tourists”, isn’t a headline that is likely to go down well with a group like Tourism Australia.

But Example 9 looks very much like the tip of the iceberg in terms of just how poorly the Revenue NSW payroll tax relief initiative has been thought out.

The most striking element of the practice note is that it fails entirely to contemplate any example where a practice is not an employer.

That might very well be seen as misleading.

All nine examples in the note contemplate only that a practice is an employer. This ignores entirely the reality that a good proportion of practices are either already operating as true service entities that don’t attract payroll tax for tenant doctors, or are rapidly remediating their processes and structures so they are protected from any future payroll tax audits.

The note also makes no mention of possibly the most important case in terms of precedent for payroll tax rulings which is a NSW case – Thomas and Naaz – or last year’s comprehensive Queensland Revenue Office ruling on payroll tax, which many other states and key GP institutions are looking to as a major form of guidance moving forward on the issue.

Practice advisory lead and payroll tax commentor David Dahm told HSD that failing to mention at any point in the note that there is a very clear set of rules now that distinguish between a medical practice that might attract payroll tax, even if it has doctors as contractors, and a service entity, that effectively just has doctors as tenants which they provide space and services for via contracts, is adding to confusion.

“Making the distinction clear to practice owners and GPs should be the first thing that the note explains before it gets into any detail around how you might or might not attract some sort of payroll tax relief,” Mr Dahm said.

“By not outlining the basics properly at the start and by failing to reference key principles that came out of Thomas and Naaz, the 1978 Philips Services Entity case, and now the Queensland payroll tax ruling, which point to how a service entity set-up can largely avoid payroll tax altogether with an appropriately structured business, Revenue NSW is creating conditions where certain practice or entity groups will think they have no other option other than pay the tax.

“But Thomas and Naaz and now the Queensland payroll tax ruling very clearly point out the ways an entity with doctors on premise can be structured where there will never be payroll tax levied on tenant doctors.”

Mr Dahm, who has a son who served in the armed forces, was perplexed and upset by Example 9.

“It looks like Revenue NSW really haven’t thought through the impact of locking out DVA payments, both from a political point of view, and in terms of simple logic,” he said.

“The payment is pretty much the same as a Medicare payment, so why would you make this payment in particular out of scope.

“I imagine there is going to be a fair bit of blowback from a lot of lobby groups when they realise what Revenue NSW is effectively doing here, discriminating against vets.”