At least we’re not the US. Nevertheless, Mr Butler needs to pull his Big Boy pants up and separate the other kids fighting in the sandpit.

It’s been an extraordinary week in the private hospital and insurance world, both at home and more extremely and horrifically, in the United States.

Domestically, one thing has become very clear. If the federal government seriously believes it can sit back and wait for the private hospitals and private health funds to set aside their not inconsiderable differences for the good of the sector, it is kidding itself.

The rhetoric between the Australian Private Hospitals Association – the body that represents about 75% of hospital operators – and Private Healthcare Australia – the peak that represents the health funds – has deteriorated this week.

The APHA, as HSD reported, dropped a bombshell, telling the feds that unless they tip $1.3 billion into the private hospitals sector over the next two years, more facilities will close, sending hundreds of thousands into the public system, leading to swamping of an already overburdened sector.

To be fair to the APHA, its arguments were not targeted particularly at the insurers, but it wasn’t backwards in coming forwards, either.

“As the private hospitals sector has felt the pressures of inflation, supply shocks and other conditions, it is evident that private health insurers have continued to thrive. A report by the ACCC for FY 2022-23 identified a net profit increase of 110% for PHI providers. At the same time, complaints made against PHI providers increased by 26.8% from 2021-22, with over 900 benefits-related complaints of all 3429 complaints made, being received in 2022-23. This has only had the effect of undermining confidence in the private healthcare sector at large.

“Note that there has been a decrease in the proportion of people covered for hospital treatment in the June quarter of 2024, compared to March 2024. It would be reasonable to assume that this is both a symptom of the high cost of living and of the shortfalls in PHI coverage. The costs of private health insurance are increasing for patients. The reduced affordability of private healthcare and falls in PHI membership will result in lower growth in private hospital separations and, consequently, operating revenue.”

In response, PHA came back with language that was in no way, shape or form conciliatory or encouraging of further civilised negotiations.

The APHA’s proposals were “demonstrably incorrect” and “tone deaf”, while private hospitals were “failing business models” and pretty much on the way out.

“We do not need more private hospitals in Australia’s big urban centres,” said PHA CEO Dr Rachel David.

“Our private health system is evolving along with clinical practice around the world to provide more convenient care to consumers in their homes.

“A natural adjustment is underway in Australia. It reflects a global trend and will continue to be shaped by consumer demand.”

None of that sounds particularly conducive to a productive chat, does it?

The good news – if you can call it that – is not all private hospital operators agree with the APHA proposals.

According to the Australian Financial Review on Wednesday, Martin Bowles, CEO of Calvary Health Care and a former secretary of the DoHAC, said the APHA’s plan wouldn’t solve the problem.

“I understand we’ve got a short-term issue. I don’t think putting the cost of that at the feet of patients is the answer, and I’m not sure a sugar hit from government equally is the answer [either],” Mr Bowles was quoted as saying.

“This notion that we can just keep piling on the patient as they use the services, it’s not going to be good for the long-term system. There has to be a much deeper conversation and the government has actually initiated that.”

That would be the Private Health CEO Forum health minister Mark Butler has announced in response to the Private Hospital Financial Viability Health Check.

Brett Heffernan, CEO of the APHA, isn’t on that forum, by the way. And neither is Dr David. Perhaps the individual companies and funds will do better without their peak bodies wielding their umbrellas.

The use of the words “tone deaf” out of the mouth of a private health insurance fund advocate was particularly jarring this week following the horrific occurrence on the streets of Manhattan Wednesday morning US time.

Brian Thompson, CEO of UnitedHealthcare, the biggest health insurer in the US, was assassinated by a lone gunman as he was walking into an investors conference.

At the time of writing nobody had been arrested, but some details have emerged which suggest this was a protest about the company’s policies and methods.

For example, words were found on the shell casings. Specifically, “defend”, “deny” and “depose”, allegedly commentary on the methods used by US insurers to reject, or delay payments to both patients and clinicians.

Is any of this relevant to Australia? Perhaps not. But one thing is clear – there is no love lost for health insurance companies even in our happy-go-lucky neck of the woods.

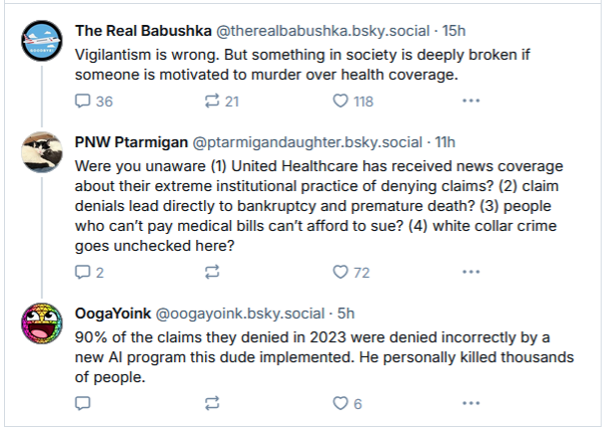

Here are some examples of reactions online to Mr Thompson’s murder:

The reward out for the person who shot United Healthcare's CEO isn't even enough to cover 1/9 of the bill we got for 28 days of radiation.

— Marie Enger (@soengery.bsky.social) 5 December 2024 at 07:00

[image or embed]

Unpleasant stuff, all of it.

Now, I am in no way suggesting that Australian private health insurers are behaving as egregiously as their US colleagues – in fact, I suspect from past conversations that Dr David would tell me that such practices are illegal here.

But honestly, does anyone think even Aussie funds are going to do anything other than protect their shareholders and their bottom line? That’s what being in business is all about, after all.

The US is just the extreme end of what can happen when profit-making is taken to its logical conclusion.

And no matter how often Australian funds say things – as Medibank did when announcing a new program yesterday – that they’re doing things in order to make “healthcare more accessible and affordable”, we know that that’s not out of the goodness of their hearts.

It’s good business. It’s good capitalism. It’s good for shareholders.

I for one am grateful that we are not dabbling in the US’ end of the health insurance pool.

But the rhetoric from the peak bodies this week over the future of Australia’s private health sector suggests that we’re a long way from the shallow end as well.

Mr Butler needs to put his Big Boy pants on, because it doesn’t look like the hospitals and insurers are prepared to.