What happens when the right people start looking more closely at how state health departments procure big tech and consulting?

A couple of interesting things happened this week which have the air of some sort of canary in the coalmine for some of our state health departments, in terms of how they are procuring new technology and associated consulting services.

The first squawk of said canary might have occurred last year with the NSW government’s inquiry into the use and management of consulting services, where it emerged that NSW Health was relying on consulting firms to manage any conflicts of interest they might have, rather than managing them themselves.

NSW Department secretary Susan Pearce admitted to the inquiry that she could not make any firm promises that a problem regarding conflicts of interest, such as board members of local health districts being involved with consulting firms like PwC, would not happen again.

“There are conflicts all over the place [and] there are requirements upon professional individuals to manage their conflicts,” she told the inquiry.

One of those embarrassing conflicts was that the acting CEO of PWC Australia at the time had been on the board of a major NSW LHD for a couple of years prior to that LHD awarding PWC a pretty large contract.

Hold the thought about an admission of near definitive conflict in the NSW procurement process.

Now ask yourself what might have happened in Western Australia earlier this year when that state’s department of health awarded an $8.4 million contract to Deloitte in February for a hospital e-referral solution – which was slated to start in March, although the tender was originally posted nearly two years prior. Deloitte was partnering in their bid with Salesforce and the secure messaging vendor Healthlink.

It has emerged that there were a few other parties tendering, all of whom were tendering at around the $4 million mark.

Some of those other parties were proposing, on spec, what looks like may have been as good or better “interoperable” and “flexible” cloud-based technology solutions, and at least two of them were Australian-based vendors, one which was Perth based.

I say “on spec” because the winning tender includes Healthlink and while Salesforce is a cloud-based vendor, Healthlink operates a much older point-to-point secure messaging technology solution which doesn’t lend itself to the sort of interoperability you can achieve with an all-cloud solution.

As a part of the tender document, 20% of the criteria for determining a winner for the tender was listed as “value for money” and WA first.

It might be that the Salesforce/Deloitte/Healthlink tender simply met criteria that the other parties could not deliver that WA Health was quite particular about.

But is the huge anomaly in price and hard to see major difference in ability of technology to deliver to the contract explained anywhere by the WA Department of Health?

Not that we’ve been able to find – there was never an announcement officially – nor that the WA Department of Health has been willing to provide to us, so far (we didn’t give them much time, to be fair).

The only notice of the win is buried inside the state’s tender website and the details of the win are sparse.

It could be all above board and a perfectly sensible decision made by WA Health.

But it’s not at all publicly obvious why such a major contract was awarded to a Big Four consulting firm and a giant software global corporate, over a couple of local vendor bids, at more than double the price of the next bid.

It looks bad, even if it isn’t.

That’s an increasingly big problem for not just the WA state health department, but for all state health departments, because with all the suspicion surrounding how the Big Four operate these days – and frankly, evidence is now emerging of some of them operating in a corrupt and deceptive manner – awarding contracts of the size and importance of this one in WA is eventually going to attract a lot more scrutiny.

It’s not like Deloitte doesn’t have the sort of problems PWC has had in the last year or so in terms of conflicts of interest.

The recent senate inquiry into the Big Four found Deloitte to be having very similar issues of conflict of interest as PWC when it failed to notify the National Audit Office of its simultaneous audit and assurance roles at a government agency.

Deloitte responded to the inquiry finding by saying:

“We respect the privilege of working with the public sector and we take seriously our responsibility to hold ourselves to the highest standards of ethics and professionalism and to deliver value-based outcomes to our government clients.”

Oh, okay. Everything should be all right then?

Notably Deloitte in WA was a controversial partner in a contract with WA Primary Health Alliance a few years back to help manage the build of a $10 million data lake for PHNs around the country.

The contract was controversial because WAHPA was using $10 million of federal government money to build a data lake and analytics service which had the aim of collecting and analysing as much deidentified patient data from general practices all around the country as possible in one place, via the national PHN network.

As a part of what they were doing WAHPA applied to the ACCC to get a ruling about whether what they were doing was going to be classified as a monopoly at some time in the future, which gives you some sense that even WAHPA may have thought they were on fragile ground in what they were attempting.

Collection of deidentified patient data by PHNs was sanctioned by the government only as part of a very well-defined quality improvement program for general practice (QPIP). But there ended up being several instances of data being extracted from practices by PHNs where every piece of data was extracted from a practice patient management system, not just the few data fields required to process QPIP.

Today a lot of people, including the federal government (ironically given their initial funding of the project) aren’t very happy with how this data is being collected and managed by PHNs and commercial vendors and it has been speculated that the entire project might end up being taken over by the AIHW on behalf of the federal government.

The federal government does not want either PHNs or commercial companies managing mass patient data extraction and storage any more (they are OK for PHNs to continue doing data analysis of the data within their regions), so the future of this project is now in significant doubt.

It turns out that the immediate previous job of the digital health transformation manager for WAPHA when the contract was initially awarded was as a consulting partner for Deloitte in WA.

Deloitte remain heavily involved in the project.

Yet again, I have to point out, that although the optics of such an arrangement don’t look fantastic these days given all the inquiries into the Big Four firms and accusations of conflict of interest in Canberra and NSW, there is nothing illegal about such an arrangement.

The other major partner in the WA Smart Referral tender, Salesforce, isn’t travelling too well in the conflict of interest inquiry stakes in the past few weeks either.

A week ago the group disclosed to a joint committee of public accounts and audit inquiry in Canberra that it gave gifts worth more than $100 to NDIS staff at least 45 times over a period of a few years.

The software company had also held at least three meetings with then NDIS and government services minister Stuart Robert at his request less than a year before the company was awarded a lucrative contract for the NDIS now worth more than $100 million.

In some of those meetings with Minister Robert and Salesforce was the now infamous consulting firm Synergy 360.

Of course, none of this means that there is anything wrong with how this particular WA tender was run and won.

But in the light of recent parliamentary inquiries at the federal level the optics look pretty bad while the WA government chooses to not even announce the winner of the tender as they often do when a big health project comes online, or provide any details to anyone of why Deloitte and Salesforce won the tender over the other bidders, when they were double the price.

Salesforce is a major player in a lot of bids these days for state health work and you will often see them go in with a Big Four consultant.

It looks a lot like Salesforce is the major provider of a similar e-referral solution to the SA Department of Health but there does not appear to have even been a tender for this work anywhere.

Early last year consulting firm Mav3rik embarked on a publicity drive in a few national IT magazines to announce how it was helping to design an e-referral management system for SA Health which was built on Salesforce and, like WA, was using Healthlink for secure messaging.

SA Health was already using Healthlink and Salesforce for other services, which might explain why there was never a tender for what is a major and potentially transformational piece of interoperability infrastructure for that state.

If Salesforce was already in use in that state, then Salesforce may have been able to sneak in under cover on the e-referral contract, via pre-existing statewide licenses for its CRM for the other services it was providing.

Who knows? Who cares?

Well, someone should start caring.

Turns out Mav3rick is essentially a major downstream integrator for Salesforce and Mulesoft and key staff at this consultancy once worked for Saleforce and sit on the advisory board of Salesforce.

I have to keep saying it: there is nothing illegal with such an arrangement.

But why is SA Health not putting such a major project to tender so it can at least end up in the orbit of a state audit office, should something go horribly wrong in the future?

And how much will SA Health end up paying for this e-referral system, by the way?

Is it possible that in SA other bidders, if given the chance via a public tender process, might have been able to offer better solutions at significantly less cost?

I’m not sure anyone will ever know because this particular contract does not look to be visible for any sort of appropriate scrutiny.

Salesforce has now popped its head up in Queensland in respect to e-referral type work and other digital services for hospitals, with two lengthy reports in industry newsletter Pulse IT about strategic deals in Metro South and North, two of the largest HHSs in the state.

The Pulse IT report says that Metro South Health has signed a “strategic partnership with Salesforce to support its ambitious digital transformation program” that “will initially focus on using the Salesforce platform to enhance waitlist management”.

But according to the story the breadth of what Salesforce might end up doing includes a “digital front door as a platform for communication between Metro South, external healthcare providers and patients that will facilitate automated surveys, bi-directional communications and more efficient collection of pre-admission data” and standardisation of “processes by creating reusable patterns for workflows, integrated data, and digital forms to reduce errors and enhance overall healthcare delivery efficiency”.

I went looking for a tender or any other formal procurement process which led to this type of deal and could not find anything.

That is not to say that something doesn’t exist that might be publicly visible and auditable at some time in the future. But if nothing formally public does exist it wouldn’t be such a bad idea for someone in Queensland Health to ask what is going on.

Specifically, how much is this deal with Salesforce worth? How did it come about? What is the overall nature of the deal? And if this is just a foot in the door exercise or a pilot, would that unfairly bias any future procurement process if the state should go to a much larger tender for services of this nature?

This is all in the light of the last few weeks of parliamentary inquiries in Canberra where the behaviour of Salesforce in acquiring government contracts has been called into question quite a bit.

All to say that if you’re in a state health department and you’re not yet hearing some faint and distant chirping from a government procurement big tech consulting firm canary, you might need to have your hearing checked.

At the federal level the Big Four and a few big tech players have been copping a bollocking in the last six months via senate inquiries in terms of conflicts of interest and value for money in federal government procurement.

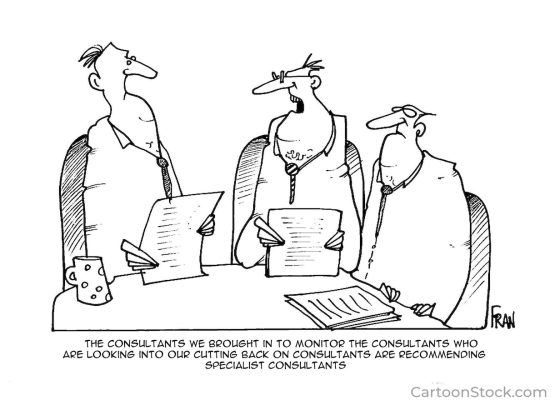

This week we saw what might start to come of such scrutiny when the Australian Digital Health Agency put out a $550,000 tender for a consultant (wonderful irony here) to, essentially, work out a plan to fire all their external consultants over the next two to five years.

The tender says they want to move most of everything they do in IT to in-sourcing but it means the same thing.

It feels a lot like a reckoning might be coming for how big consulting and big tech are working their ways at the state level in health procurement as well.

That means state health departments probably need to think a lot more carefully about how they are interacting with some of these big consulting and tech players and make sure they are crossing their t’s and dotting their i’s.